Introduction: Why the AI Craze Is Everywhere

From Silicon Valley to Wall Street and even your favorite social media feeds, Artificial Intelligence (AI) has rapidly become the most talked-about technology of our era. The world’s biggest companies—Nvidia, Microsoft, Google, Meta, Amazon—are pouring hundreds of billions of dollars into AI models, data centers, and chips. Startup founders and investors are chasing the next “AI unicorn,” while global news headlines debate if all this hype is building up to the greatest tech bubble in history. This blog explores what’s really happening, whether we’re in a bubble, and what it could mean for America and the world.

AI: The Engine Powering the US Economy

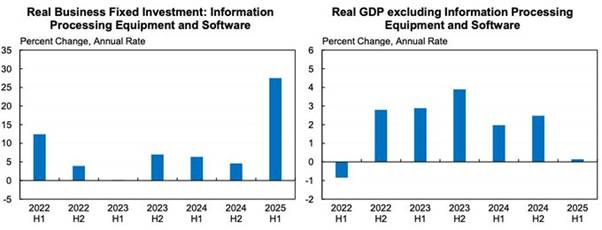

- In the first half of 2025, AI-related investments contributed a whopping 1.1% to the US GDP—the highest of any sector, even ahead of consumer spending.

- Major US tech giants are investing at an unprecedented scale: Nvidia and Microsoft have both hit over $4 trillion in market value, mainly driven by AI.

- Infrastructure for AI—data centers, chips, power grids—has reached a $400 billion run-rate for 2025, making up nearly a third of the US stock market’s total value.

- Several experts argue that, without this AI investment boom, the US economy might already be in a recession.

How AI Spending Shows in Real Life

- Cities like Abilene, Texas have seen new data centers built for AI, creating jobs and fueling local economies.

- AI is driving demand for everything from rare minerals to real estate for server farms.

- The surge is so strong that, according to some analysts, 92% of GDP growth in early 2025 was due to computer equipment spending for AI.

“The Bubble Question”: Experts Sound the Alarm

Despite the enormous optimism, criticism and warnings are also everywhere:

- Top economists compare today’s AI boom to the dot-com bubble of the 1990s—when internet hype led to massive investments, but many companies crashed and burned.

- Some surveys show over 50% of investors think we’re already in a bubble.

- Companies are taking on huge debts to fund rapid AI expansion, just as they did in previous bubbles.

What Makes It a “Bubble”?

- Many AI companies—especially those developing advanced models—are losing billions annually, even while making the headlines.

- Several applications of AI still fail to deliver real-world results: AI-based teachers, search engines, or therapists have been found to perform poorly in critical tasks.

- Investment is hyper-focused: Just a handful of firms account for most of the investment, meaning risks are highly concentrated.

What If the Bubble Bursts? Possible Consequences

Many economic indicators look bright—but the underlying risks are real:

- If AI spending were to plunge, the US could see an immediate drag on economic growth, as so much GDP is now tied to AI infrastructure spending instead of traditional consumer activity.

- An AI crash could ripple through the global economy—since the US sets the pace for global tech trends and investment.

- Everyday Americans could feel the pinch through stock market turbulence, job losses in tech, and reduced corporate profits, potentially even triggering a mild recession.

Why Some Experts Remain Optimistic

- Proponents argue that unlike the dot-com boom, many AI leaders are profitable and building transformative technologies with real long-term potential.

- AI is already raising productivity in industries like logistics, healthcare, and finance.

- Massive infrastructure investments could “lay the tracks” for economic growth, much as early investments in electricity or the internet did.

The Human Impact: Winners, Losers, and What’s at Stake

For Workers:

- New jobs are emerging in data center management, chip design, and AI model development.

- But routine office jobs may be disrupted or eliminated, pushing workers to upskill or retrain.

For Entrepreneurs:

- Startups with strong technical teams and real-world business models can attract huge funding, but the competition is fierce.

- Those offering only “AI hype” risk falling fast if the market shifts or hype dies down.

For Everyday People:

- AI-driven services are appearing in everyday life (customer service bots, personalized recommendations, AI-powered apps), with more to come.

- Rising AI investment can mean more innovation—but also higher costs for goods, a side-effect of surging hardware investment and global supply chain strains.

Looking Forward: Is This Boom Here to Stay?

- Even if the AI investment cycle cools, the long-term vision for AI shaping the next era of productivity and science remains strong.

- AI could add trillions in value to the US economy—from smarter manufacturing and logistics to new discoveries in healthcare, climate science, and beyond.

- However, wise policy, broader investments in skills and worker protections, and close attention to economic signals are essential to avoid repeating the mistakes of previous tech booms.

Conclusion: Optimism with Open Eyes

The AI wave is real—powering the US economy, driving new innovations, but also bringing enormous risk if hype overtakes reality. Whether this is truly a bubble, a gold rush, or a “new normal,” one thing is certain: The balance between bold investment and careful realism will decide who thrives and who falls behind in this new era

So, is the AI bubble going to pop?

Nobody knows for sure, but history shows it’s always better to invest in skill, resilience, and genuine problems solved—rather than pure hype. For creators, entrepreneurs, and everyday users, staying informed and adaptable is key. The future, powered by AI, is still being written.