SoftBank’s $5.8 Billion Nvidia Shakeup: How One Bold Move Is Fueling the Next Generation of AI ?

SoftBank Group, the Japanese technology conglomerate led by Masayoshi Son, has made headlines around the world by selling its entire stake in Nvidia for $5.8 billion in October 2025. This strategic decision isn’t just about profit—it’s about betting big on what could be the single most transformative wave of artificial intelligence investment the world has seen. Let’s explore the full story, step by step, and how it could reshape the technology landscape for years to come.

Decoding the Sale: Why SoftBank Cashed Out on Nvidia

In October, SoftBank sold all 32.1 million shares it held in Nvidia, generating a cash windfall of $5.8 billion. This wasn’t an impulsive move—it was a calculated strategy, shifting focus from hardware (semiconductors) to the infrastructure and software layer that powers AI.

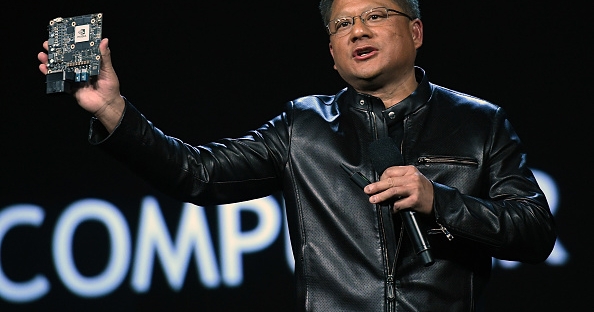

- Background on Nvidia’s Rise: Nvidia has been at the center of recent tech booms, with its chips powering the servers and data centers behind AI giants like OpenAI and Google.

- SoftBank’s History: SoftBank had previously increased its Nvidia stake to about $3 billion, so this deal represented a sizeable profit.

Masayoshi Son’s decision to sell signals a belief that the next major gains won’t come from chip stocks, but from companies directly building the future of artificial intelligence.

Funding the Future: OpenAI and AI Infrastructure ?

The Nvidia sale didn’t just pad SoftBank’s coffers—it set the stage for a massive investment in OpenAI and related AI infrastructure projects. Here’s how those billions are expected to fuel the next generation of technology:

OpenAI Stake: A Record-Breaking Bet ?

- $30 Billion Commitment: SoftBank approved a $30 billion commitment to OpenAI in late October, aiming to become a cornerstone investor in the ChatGPT creator.

- Syndicate Funding: Son announced plans to syndicate $10 billion to other major co-investors, amplifying the financial muscle behind OpenAI’s expansion.

- Why OpenAI?: OpenAI’s cutting-edge platforms are revolutionizing everything from business automation to scientific research—and SoftBank wants a front-row seat.

Stargate Project: Building a $500 Billion AI Superstructure

In January, SoftBank joined forces with OpenAI and Oracle for the Stargate initiative—a $500 billion project to construct the world’s largest AI infrastructure platform in the United States.

- What is Stargate? The plan includes developing ultra-large data centers across several U.S. states, creating a backbone for global AI progress.

- Current Status: Five new data center sites have been selected, pushing Stargate’s capacity close to 7 gigawatts—well ahead of schedule.

- Global Impact: This infrastructure will empower AI startups and enterprises around the world with faster, more reliable computing power.

Ampere Computing Acquisition

- Ampere Deal: SoftBank announced a $6.5 billion acquisition of chip designer Ampere Computing. This strategic addition will accelerate AI processing capabilities for its ventures.

The Vision Fund: Soaring Profits and New Horizons

SoftBank’s landmark moves aren’t just about vision—they’re already making waves in financial markets.

- $19 Billion Gain: The company’s Vision Fund posted a $19 billion investment profit in the second fiscal quarter. This was driven largely by revalued holdings in OpenAI, highlighting both investor enthusiasm and the rapid pace of AI growth.

- OpenAI’s Rising Valuation: SoftBank participated in a $6.6 billion share purchase from OpenAI employees at a peak $500 billion valuation in October—up from $300 billion in April.

- Stock Performance: SoftBank shares have soared over 140% this year, with a 4-for-1 stock split slated for January 1, 2026. This has turned Son into Japan’s richest man, and brought renewed optimism to the company’s future.

Behind the Scenes: Strategy, Risks, and Market Reactions

Son’s Vision: Betting Big on the AI Revolution

- Masayoshi Son’s Approach: Known for bold, sometimes controversial bets on technology, Son is channeling SoftBank’s resources toward what he believes is the “start of a new era of innovation”.

- Diversified Portfolio: In addition to OpenAI, SoftBank is also eyeing partnerships and infrastructure deals with companies like Oracle and Taiwan Semiconductor Manufacturing Co.

Concerns About an AI Bubble

While SoftBank’s aggressive moves signal confidence in AI’s future, some analysts and investors worry about a potential bubble.

- Valuation Challenges: The huge sums SoftBank and its partners are committing may not immediately generate profits to justify the astronomical valuations of AI firms.

- Market Uncertainty: Technology stocks are often volatile, and there’s concern that the current euphoria around AI could fade if the sector faces setbacks.

Step-by-Step Breakdown: How SoftBank’s Moves Affect the World ?

Let’s break down the impact step by step, so readers can see why this story matters globally.

1. Capital Shift from Hardware to AI Platforms

SoftBank’s exit from Nvidia shows a shift in tech investment focus—away from the hardware manufacturing cycle and toward the software and infrastructure driving next-gen AI applications.

2. Building the Backbone for Global AI Growth

With Stargate and similar projects, SoftBank is helping build the physical platforms (data centers, chips, connectivity) that will power AI innovation everywhere.

3. Democratizing AI Access

By investing in OpenAI and launching joint ventures like SB OAI Japan, SoftBank is working to make enterprise-grade AI solutions accessible to businesses worldwide, not just in the U.S. or Japan.

4. Financial Market Impacts

SoftBank’s stock rally, boosted by these moves, serves as a benchmark for how investors worldwide are betting on the future of AI.

5. Risks to Watch

The potential for an AI “bubble” and uncertainty around long-term well-being for investors means markets will be watching SoftBank’s performance very closely over the next several years.

What’s Next: A New Era for Tech?

As data centers rise, investments pour in, and new AI ventures flourish, SoftBank’s bold decisions could shape innovations in everything from healthcare and education to finance and transportation. The world is watching as Masayoshi Son and his team redefine what it means to invest in the future.

- Innovation Will Accelerate: Global AI capabilities will improve rapidly as infrastructure scales, unlocking new applications in almost every sector.

- More Competition: Rival companies are likely to respond with their own big moves, leading to a more dynamic landscape.

- Enduring Uncertainty: Investors, creators, and consumers must be ready for volatility, but also optimism as the world moves toward smarter, more interconnected technology.

Final Thoughts: Why This Story Resonates Worldwide

SoftBank’s $5.8 billion Nvidia stake sale is more than a headline—it’s a signal that the global race to build the future of AI is accelerating. Whether you’re an entrepreneur, a developer, a business leader, or an ordinary consumer, the implications are both exciting and profound.

This move empowers the development of technologies that will touch lives globally, paving the way for smarter businesses, better healthcare, and more efficient public services. It also reminds us that risk, innovation, and vision go hand-in-hand in shaping tomorrow’s world.

Stay tuned as SoftBank’s story continues to unfold—and as the next chapters in the ongoing AI revolution are written before our eyes